Our Pricing & Valuation solution in a nutshell

The number of models is business is growing exponentially, used for cost allocation, price quoting, valuation, risk assessment and numerous other topics. Many of these models, especially early versions, are developed in Excel as it is effective, flexible and has a large userbase.

Excel however has its drawbacks, as models need to be executed manually this takes time and opens room for typos and formulas to be knocked over. Results from manual Excel usage always carry that risk of error.

To address these issues, Model Risk Management is a topic in financial institutions. Not only do you need to be confident intended versions of models and inputs were used, you now need to prove this.

For manual Excel usage this means four-eyes by a second person, performing scripted checks and documenting each result. This is tedious work that delays the turnaround time without actually fully containing the risk.

How we can help

XLConnect reduces manual work and Model Risk by controlling workbook versions, automating data movement and logging details for audit. This makes it easy to get it right the first time and prove that.

Models are stored in the Model Library that keeps track of model versions and their correctness. It also supports deployment so you can be sure starting monday every new deal is priced with the new approved version.

The Data Lake allows data to be separated from workbooks, this allows approved models to be reused and automates data movement to eliminate typos and save time.

The details of this are stored, so you can prove the correct model was used with the correct inputs. This replaces the need for manual four-eyes checks and saves considerable time during audit.

XLConnect removes effort, human error and the need for four-eyes from model execution, meaning you can have clear results you can trust and prove in a fraction of the time.

XLConnect supports Pricing and Valution in three ways:

Way 1: The Model Library

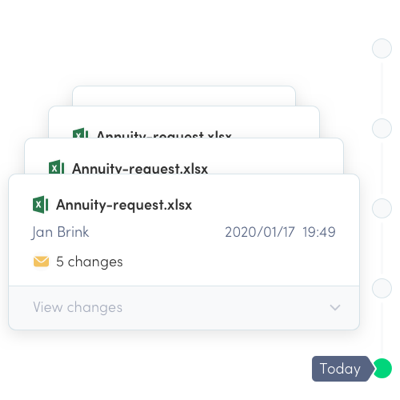

The XLConnect Model Library handles version management for workbooks with tracked changes and unit testing.

It records individual versions of Excel workbooks, including what version it was derived from and the changes between them. Every version has a unique id that can be used to retrieve that exact bit-perfect version at any point in the future and deploy it to production with confidence.

Way 2: The Data Lake

The XLConnect Date Lake allows workbook cells to be connected so data can be stored outside of the workbook. This turns workbooks into testable, reusable components and lets the data flow between them in a controlled and transparent fashion.

Like workbooks, these data messages have a unique id, are strictly versioned and keeps track of how they weere created (workbook, user, and inputs).

This data lineage can be drilled through all underlying workbooks and messages, creating a audit trail that explains completely how any message was created and makes it reproducible.

Way 3: Automation

Automation the execuion of large number of models (and runs to isolate effects like time value and interest) saves time and prepare all details required for audit.

Handsoff execution with workbooks from the Library and data from the Lake means processes built in Excel are now completely controlled. This combines the stability of IT with the agility of Excel.

XLConnect, a complete solution for Pricing & Valuation

Together these features extend Excel, automating repetitive work in controlled workflows while remaining completely transparent and flexible. See how XLConnect can streamline your Pricing & Valuation by scheduling a demo today.