Private Equity

Automate reporting from a heterogeneous, changing organisation and connect to valuation models and stakeholder reports in Excel

Request demoOur Private Equity solution in a nutshell

Investing in a diverse portfolio companies requires accurate and timely information about future cashflows and the drivers underneath, for valuation models and investor reports.

Many of these companies however will go through rapid growth and change, often being consolidated from acquisitions. Hardly a good time to pause operations to implement a reporting system.

This typically means Excel sheets are emailed and consolidated manually, bringing tedious work and room for typos.

Firm side these reports need to processed manually again, by the proverbial 'Excel jockeys', to be fed to valuation models and investor reports.

All of these operations take time and produce numbers that are hard to analyse, as every copy paste action obfuscates the source of the numbers.

How we can help

XLConnect lets you automate the reporting through existing Excel sheets, connecting them into workflows that process the numbers automatically while keeping a transparent audit trail.

Companies and teams within (sales, research and dev, hr) can enter their numbers into templates, this information is rolled up for the company and across the hierachry of investment vehicles.

When they have systems locally, local teams can create derivatives of the templates and connect these to their internal systems through SQL and REST.

Rolled up information about cashflow projections can be aggregated through investement vehcles and portfolios to total level, then fed back to investor reports

Automating this process without becoming dependent on IT for every small changes frees up time and resources while creating clear insights. Reports created through XLConnect are very clear as you can drill through any report to see the numbers underneath.

XLConnect supports Private Equity reporting in three ways

Way 1:The Model Library

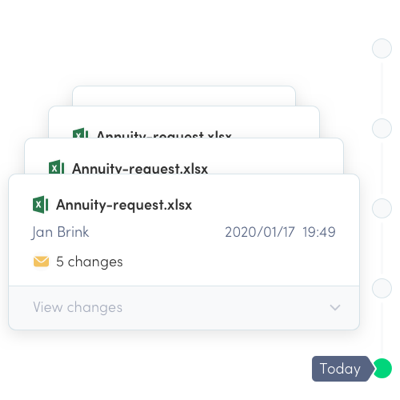

The XLConnect Model Library handles version management for workbooks with tracked changes. It records individual versions of Excel workbooks, including what version it was derived from and the changes between them. Every version gets a unique id that can be used to retrieve that exact bit-perfect version at any point in the future

Way 2: The Data Lake

The XLConnect Date Lake allows workbook cells to be connected so data can be stored outside of the workbook in so called data messages. This turns workbooks into testable, reusable components and lets the data flow between them in a controlled and transparent fashion. Like workbooks, every data message has a unique id, is strictly versioned and keeps track of how it was created (workbook, user, and inputs). This data lineage can be drilled through all underlying workbooks and messages, creating a audit trail that explains completely how any message was created and makes it reproducible.

Way 3:The Approvals

XLConnect Approvals allow key users to record four-eyes and sign-offs on both workbooks and data messages. This administration is stored in the system with the workbooks and data messages and serves as the basis for model- and data governance reports. Audit no longer needs to request these approvals though emails and word documents to build a disconnected file. For every piece of information, a single click makes it clear who created it and who approved it. Combined with the data lineage this becomes a powerful tool to assert governance has been applied.

XLConnect, a complete solution for Private Equity

Together these features extend Excel, automating repetitive work in controlled workflows while remaining completely transparent and flexible. See how XLConnect can stremaline your reporting by scheduling a demo today.